DeFi vs. TradFi

- May 12, 2025

- 5 min read

Updated: May 13, 2025

The Race to Tokenize Bonds, Loans & Treasuries

Tokenization is no longer a concept waiting on approval. Bonds, loans, and treasuries are now being issued, transferred, and settled using blockchain rails. No press release needed—just verifiable contracts, transparent records, and markets that work without relying on old timelines.

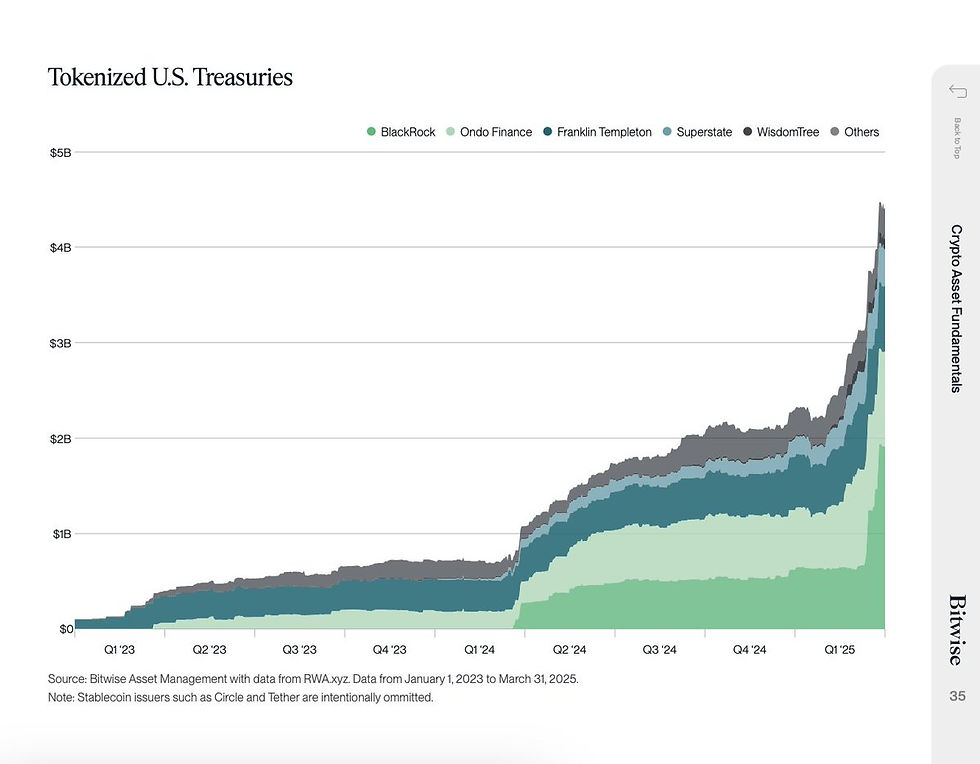

More than $6.9 billion in U.S. Treasuries now trade as digital tokens. On-chain private credit has climbed past $9.6 billion, spanning use cases from stable lending pools to real-world financing for businesses. These aren’t side experiments. They’re active markets, already clearing value across both public and permissioned chains.

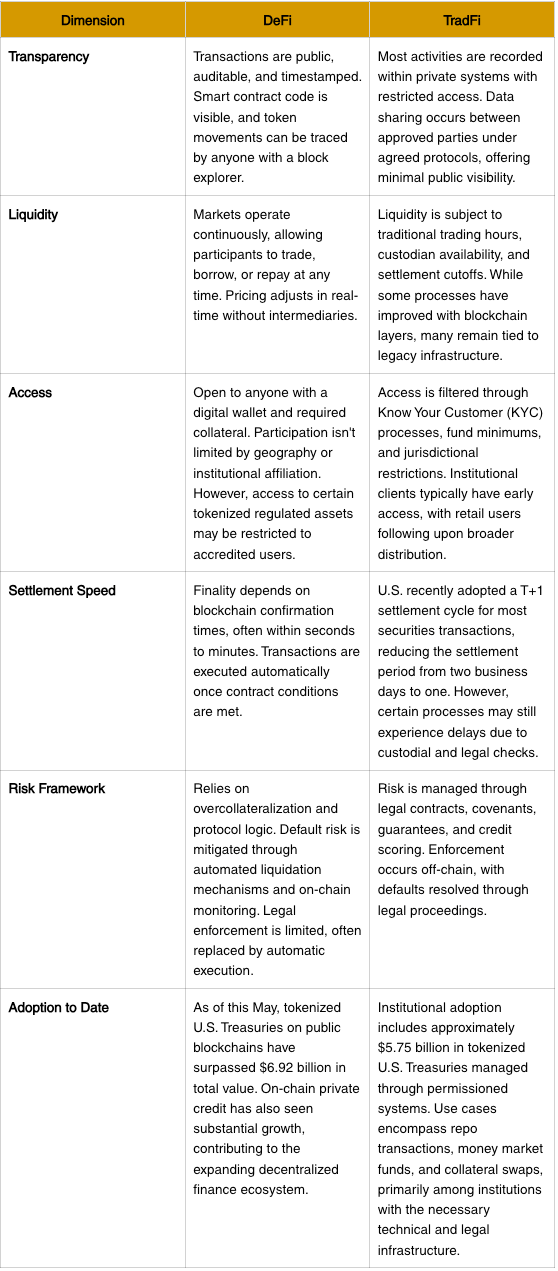

The two groups driving this forward—DeFi and TradFi—approach the process with very different systems.

DeFi automates issuance, collateral, and repayment using open protocols. Everything is visible, auditable, and self-executing. TradFi, on the other hand, integrates blockchain through private pilots and closed infrastructure, balancing efficiency gains with institutional guardrails.

Each is working with the same assets, but the structure, speed, and visibility vary widely.

The next sections compare the models, highlight what’s already working, and trace how tokenization is gaining ground without needing headlines or approval from legacy gatekeepers.

DeFi — Programmable Credit and Instant Settlement

DeFi began with tokens built for permissionless exchange. What started as simple swaps evolved into lending platforms, stablecoins, and collateralized credit—without intermediaries, banking hours, or manual approvals.

Protocols like MakerDAO and Compound automated lending logic through smart contracts. Borrowers posted assets. Interest rates adjusted on-chain. Repayments, liquidations, and position tracking happened in real time. No forms. No clearing agents.

That same logic is now applied to tokenized treasuries, private debt, and synthetic fixed-income products.

Ondo Finance, Maple, and Flux have introduced structured credit and short-duration vaults linked to tokenized T-bills. Some let users mint stablecoins backed by U.S. Treasuries. Others route investor capital toward undercollateralized business loans, with risk managed through a mix of protocol code and legal agreements.

These aren’t concepts waiting for pilots. They’re active credit rails, moving real funds, facing real defaults, and supporting lenders across regions with limited access to traditional financing.

The efficiency is built into the structure. Transactions finalize within minutes. Yields are distributed automatically. Liquidity providers can monitor loan performance in real time through public dashboards. Participation spans wallets, not regions.

But this model has constraints. Most institutional capital still needs wrappers, custodians, and onboarding pipelines. Legal clarity varies by country. And tokenized products backed by regulated assets often require off-chain components for custody or investor verification.

Despite that, DeFi-based tokenization has advanced steadily. Treasury-backed tokens on public protocols now exceed $6.9 billion . Tokenized private credit across open platforms is projected to reach between $15 and $17.5 billion by 2026 . These markets are no longer limited to early adopters.

DeFi hasn’t waited for green lights. It’s built around execution—automated, transparent, and global by design.

What it’s proving is simple: when the tools work, capital flows without delay.

TradFi — Compliance-First, Still Testing

Traditional finance is not ignoring tokenization. It’s responding on its own terms.

Institutions that manage trillions don’t overhaul infrastructure overnight. They layer new tools on top of existing systems, experiment within controlled pilots, and work through compliance teams before engineering ones.

That’s why most TradFi-led tokenization happens behind permissioned chains—blockchains where access is restricted and transactions are visible only to approved participants.

This isn’t due to a lack of interest. It’s how institutions manage risk, legal exposure, and fiduciary duty. What looks slow from the outside is often methodical—designed to meet rules that DeFi doesn’t yet face.

Still, there’s visible movement.

Goldman Sachs has tested tokenized money market funds on its GS DAP platform. Franklin Templeton already runs a public blockchain fund that uses Stellar and Polygon to record ownership. JPMorgan continues to process collateral settlements and repo agreements on its Onyx platform. Citi has begun experimenting with tokenized FX alongside tokenized MMFs.

The progress is fragmented but real.

Each player is testing different instruments: government bonds, syndicated loans, short-term funds. Some use public chains. Others operate in closed environments. But all are tracking efficiency gains—in reduced reconciliation, in settlement speed, in reporting accuracy.

Unlike DeFi, TradFi’s involvement is driven by clients, not code. Custodians, fund managers, clearing houses—all have to agree. Risk committees have to approve. And regulators often sit in the same room as the product leads.

That’s why most of the action still looks experimental, even when billions of dollars are involved.

But these aren’t merely pilots. They’re early steps toward something more permanent.

The structure may feel familiar—terms, reporting, compliance—but the rails beneath are different. And as more institutions start to issue, redeem, and manage assets on tokenized infrastructure, the line between blockchain-native and legacy finance continues to blur.

What TradFi brings is scale. What it lacks—for now—is fluidity. But that gap is narrowing, not through headlines, but through integration.

DeFi vs. TradFi — A Contrast in Execution

Final Take

DeFi and TradFi are tokenizing the same assets with different tools.

DeFi runs on smart contracts, live dashboards, and open protocols. Settlement is fast. Terms are visible. Growth has been steady—over $6.9 billion in tokenized treasuries and close to $10 billion in private credit on-chain.

TradFi runs through pilots, permissions, and familiar processes layered with blockchain infrastructure. Activity is growing, but remains gated by compliance and internal systems.

Both are solving the same problem: how to move capital with fewer steps, fewer delays, and fewer intermediaries.

That change is already underway—measured not in headlines, but in volume.

🎥 Watch the Video

For a quick video version of this post, watch my YouTube video: DeFi vs TradFi: The Race to Tokenize Bonds, Loans & Treasuries

🗣️ Join the Conversation

I'm passionate about educating others on Bitcoin and blockchain technology. If you found this article helpful, share it with others who might benefit from it. And please don't forget to follow me for more insights!

🔗 Stay Connected:

YouTube: Blockchain and Web3 Insights

Twitter/X: @Ajay8307

Bluesky Social: @blockchainweb3

Instagram: blockchainandweb3

Threads: @atom8307

Medium: Blockchain and Web3 Insights

LinkedIn: Ajay Tomar

📩 Subscribe to My Newsletter:

For weekly updates and a special trivia question, sign up for my FREE weekly newsletter.

📚 Educational Resources:

⛔️ Disclaimer ⛔️

This article is for educational purposes only and should not be considered financial advice. Always do your own research and consult with a professional before making any investment decisions. Some links provided may be affiliate links, which help support my work at no extra cost to you.

.png)

Comments